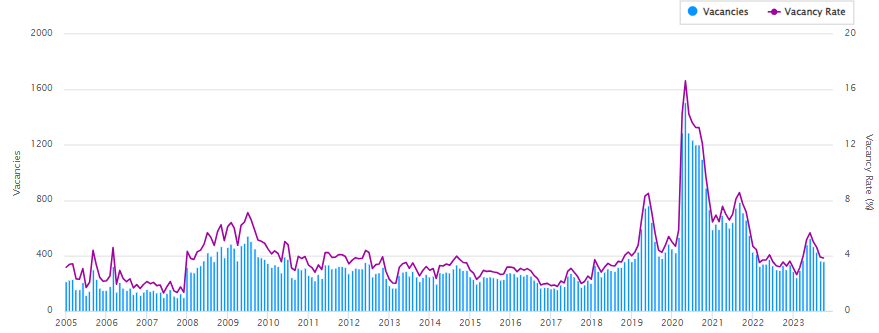

The latest vacancy rate shows that Australia’s vacancy rate remains at a record low of 0.8% for the third consecutive month.

Despite some marginal improvements in some capital cities, the rental market remains highly competitive for tenants.

- Australia’s vacancy rate remains at a record low of 0.8%.

- There are signs of stabilising conditions in some markets, with Sydney, Melbourne and Brisbane experiencing a slight increase in vacancy rates.

- The rental market is expected to reach a tipping point in 2024, driven by stretched affordability.

- More renters opting for house shares and first-home buyer incentives will help transition some to being owners.

- Fast-track others to a more affordable purchase.

Vacancy rate insights in Capital cities

- Sydney: The vacancy rate increased to 1.0%, driven by a surge in rental supply.

- Melbourne: The vacancy rate rose to 1.0%, driven by a boost to rental stock.

- Brisbane: The vacancy rate rose to 0.9%, an 11-month high.

- Perth: The vacancy rate remained steady at 0.3%, a record low.

- Adelaide: The vacancy rate remained steady at 0.3%, a record low.

- Darwin: The vacancy rate jumped to 1.5%, the highest of the capitals.

- Hobart: The vacancy rate dropped to 0.8%, the lowest since March 2023.

- Canberra: The vacancy rate fell to 1.4%, the lowest it has been in a year.

Rental Insights

The rental market is expected to remain tight in the short term, with vacancy rates likely to remain below 1% in most capital cities. However, there are some signs that the market may be easing in some areas.

In the long term, the rental market is expected to become more balanced as rental supply increases. This will be driven by a number of factors, including increased investor activity, more development, and a decline in overseas migration.

Renters will continue to find it difficult to secure rental properties in the short term. However, there are some things that renters can do to improve their chances of finding a place to live.

- Renters should be prepared to start their search early.

- Renters should be flexible with their location and property type.

- Renters should be prepared to offer more than the asking rent.

- Renters should have a good rental history.

- Renters should be proactive in their communication with landlords or property managers.

What does this mean for investors?

Investors should continue to find the rental market to be a good investment. However, they should be aware that the market is likely to become more competitive in the long term.

Investors should consider the following strategies:

- Invest in properties in areas with strong housing demand.

- Make sure your property is in good condition.

- Offer competitive rents.

Conclusion

Several factors are contributing to the tight rental market, including a chronic undersupply of rental properties, strong overseas migration, rising property prices, and affordability constraints faced by potential first-home buyers.

Investors should continue to find the rental market to be a good investment, but they should be aware that the market is likely to become more competitive in the long term.

Rents are expected to rise as vacancy rates remain low, and demand continues to outstrip supply.

Renters should start their search early, be flexible with their location and property type, and be prepared to offer more than the asking rent. Investors should invest in properties in areas with strong demand, make sure their properties are in good condition, and offer competitive rents.