Australia’s property market is poised for another significant upswing in 2025, driven by a confluence of global economic shifts, anticipated interest rate cuts, and the nation’s enduring appeal as a haven.

Global Trade Tensions and Their Impact

The recent escalation of trade tensions, particularly the US-led tariff increases, has introduced volatility into global markets. While many economies grapple with the repercussions, Australia finds itself relatively insulated. With only about 4% of its exports directed to the U.S., Australia’s primary exports—iron ore, coal, natural gas, gold, and agricultural products—remain in demand, potentially even benefiting from shifts in global trade dynamics.

Historically, Australia’s property market has demonstrated resilience during international economic downturns. Periods of global uncertainty often see increased interest in Australian real estate, as investors and migrants view the country as a stable and prosperous destination.

Anticipated Interest Rate Cuts

The Reserve Bank of Australia (RBA) is expected to reduce the cash rate in its upcoming meetings, with predictions of a 25 basis point cut in May. Some analysts even suggest the possibility of a more substantial 50 basis point reduction, depending on evolving global economic conditions.

Lower interest rates typically make borrowing more affordable, encouraging homebuyers and investors to enter the market. This increased demand can drive property prices upward, contributing to a market boom.

The RBA board last convened on April 1, just two days before the US President Donald Trump ignited a global trade dispute by raising tariffs on April 3—coinciding with Australia’s ‘Liberation Day’ (April 2 in the U.S.).

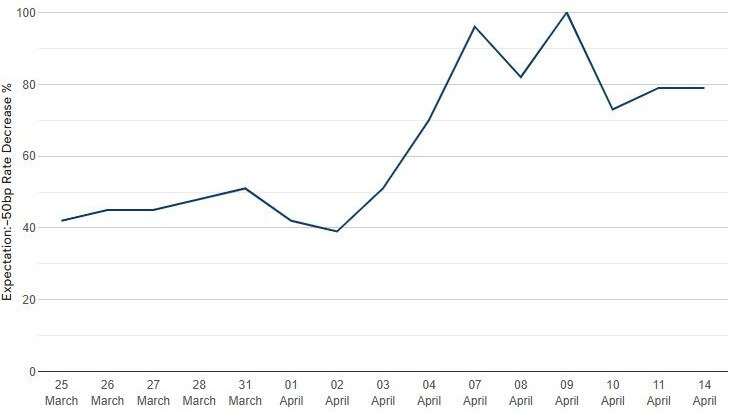

Following this, market sentiment shifted rapidly. On April 3, the ASX rate tracker reflected a 51% probability of a rate cut to 3.6% at the May meeting. That expectation surged to 100% in the following days and now holds steady around 79%.

Australia’s Enduring Appeal

Beyond economic factors, Australia’s reputation as a safe and prosperous nation continues to attract international interest. The country’s political stability, robust healthcare and education systems, and high quality of life make it an attractive destination for migrants and investors alike. This sustained demand and limited housing supply in key urban areas place upward pressure on property prices.

Conclusion

Given the interplay of global economic shifts, anticipated monetary policy adjustments, and Australia’s intrinsic appeal, the property market is well-positioned for another boom in 2025. Investors and potential homeowners should stay informed and consider strategic opportunities in this evolving landscape.