The RBA has decided to keep its official cash rate at 3.60%, a level it has held since August, after an inflation uptick that caught many by surprise.

While economists and markets widely expected this move, the central bank emphasised that cutting rates further now could jeopardise the progress on inflation. Governor Michele Bullock warned that the margin for further easing was “a bit marginal”.

Inflation Headwinds: What’s Changing?

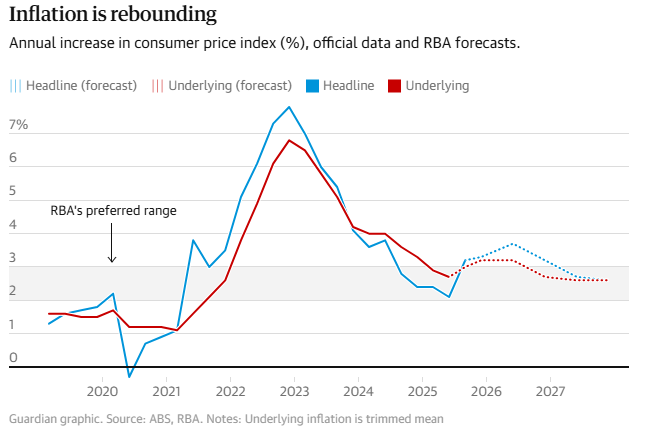

The headline story is that underlying inflation has crept up to 3.0 %, which is at the upper limit of what the RBA considers “its preferred range”.

The bank’s updated forecasts now envisage:

- Inflation is peaking at around 3.7 % by mid-2026.

- Core inflation (the RBA’s preferred gauge) was at about 3.2 % by roughly the same time.

- No possibility of the previously-targeted fall to around 2.5 % by 2027

Factors driving that shift include stronger-than-expected rents, house-price growth, and service-cost pressures.

Governor Michele Bullock explained that further rate cuts could undermine progress on inflation, noting that if rates were eased much more, it’s uncertain whether inflation would continue to decline — the forecasts suggest that outcome would be only marginal at best.

Why No Rate Cut (For Now)?

The RBA’s board explicitly ruled out a cut at its November meeting, citing concerns that doing so might reverse the recent decline in inflation.

Even though weaker employment data emerged, Bullock maintained the labour market is still “running hot” — so the central bank is reluctant to ease prematurely.

Banks and markets had also largely withdrawn the idea of a rate cut in 2026, aligning with the RBA’s cautious tone.

Implications: What This Means for Households & Investors

For mortgage-holders and property investors, the decision has several key takeaways:

- With rates staying unchanged, borrowing costs remain stable — no immediate relief for those hoping for a cut.

- On the flip side, the RBA is explicitly warning of further rises in house prices and rents in 2026. So, property-cost pressures may increase.

- Real wages are projected to go backwards by end-2026 as inflation eats into incomes.

- For investors: if rents and house prices are expected to rise, that may support rental returns and capital growth (all else equal). But it also raises affordability-and risk considerations.

The RBA is sticking with its current cash-rate level of 3.60 % while keeping a cautious eye on inflation and housing-market dynamics. The decision underscores that the era of easy rate cuts may be over — at least for now — as the Bank balances inflation risks with growth. For property investors and borrowers alike, the message is: rates aren’t going down yet, and cost pressures (rents, housing) may be heading higher.

At Success Avenue Property Consulting, we specialise in helping investors navigate the Australian property market, identifying the best opportunities and providing expert advice every step of the way. Whether you’re looking to purchase your first investment property or expand an existing portfolio, we’re here to help you achieve your financial goals.