Australia’s Home Prices Surge as Rate Cuts Ignite Buyer Demand

After months of uncertainty, Australia’s property market is roaring back to life. National home prices surged 0.8% in September, pushing the median dwelling value to a record A$857,280 (US$565,462) — the strongest monthly growth in over a year.

Over the past quarter, home prices climbed 2.2%, outpacing the 1.5% recorded in the previous quarter, signalling renewed buyer confidence and a clear market rebound across the country.

The Big Movers

- Perth: +1.6% – Australia’s standout performer, driven by booming population growth and tight listings.

- Brisbane: +1.2% – Demand remains red-hot, particularly in the affordable outer-ring suburbs.

- Sydney: +0.8% – A steady rebound as rate cuts re-energise buyer activity.

- Melbourne: +0.5% – Modest growth but signs of recovery emerging in family-centric corridors.

What’s Driving the Rise?

1. Rate Cuts Are Supercharging Borrowing Power

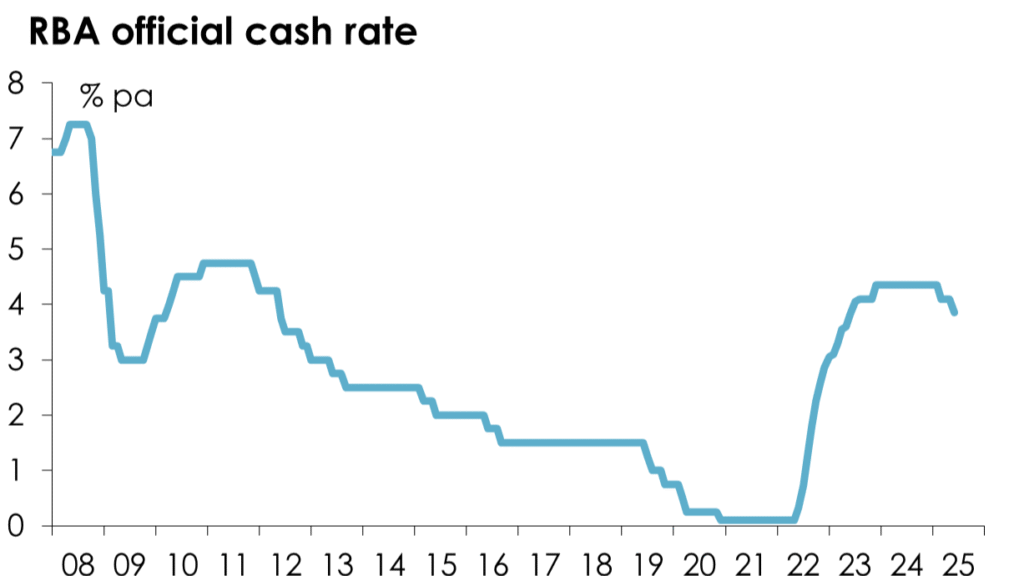

The Reserve Bank of Australia (RBA) has trimmed rates three times this year, responding to cooling inflation and a softening economy. The current cash rate of 3.60% has opened the door for more buyers, expanding their borrowing capacity and reigniting competition — especially in mid-range markets.

2. A Severe Shortage of Listings

Australia’s property listings are at near-record lows. With fewer homes available, buyer demand is outpacing supply — driving prices higher. This imbalance is giving sellers the upper hand and fueling bidding wars, particularly in well-connected metro and coastal areas.

3. First-Home Buyer Boost

Government incentives, such as the 5% deposit scheme for first-home buyers, could inject fresh energy into the lower and mid-tier markets, a move that’s injected a fresh wave of activity across entry-level housing segments.

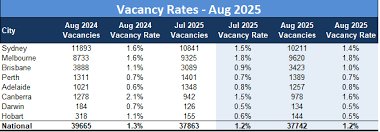

4. Rental Market Pressure Continues

Rental markets remain under immense strain. Vacancy rates have hit historic lows, while national rents jumped 0.5% in September and 1.4% over the quarter — the strongest growth in more than a year. For many tenants, buying is now a more appealing (and stable) option than continuing to rent.

The big question now is whether this momentum can last. While recent rate cuts have fuelled short-term demand, the Reserve Bank continues to flag uncertainty around inflation and economic stability. A sustained upswing will depend on how quickly consumer confidence and wages keep pace with rising property prices.

Government incentives, such as the 5% deposit scheme for first-home buyers, could inject fresh energy into the lower and mid-tier markets. However, this may also intensify competition and keep affordability under pressure — especially in cities like Brisbane, Perth, and Adelaide, where supply remains tight.

With rental vacancies hovering near record lows, many tenants are choosing to buy instead of rent. This transition could continue to underpin buyer demand throughout 2025, further tightening housing supply and sustaining price growth across key regional and metro markets.

Conclusion

The message is clear: Australia’s housing market has entered a new phase of growth, defined by low supply, renewed affordability, and expanding buyer activity.

For savvy investors, timing is everything. Early movers who secure properties in high-demand growth corridors before the next wave of price increases could enjoy strong medium-term gains through 2026.

With rate cuts boosting borrowing power and population-driven demand showing no signs of slowing, the window of opportunity is open — but not for long.

At Success Avenue Property Consulting, we specialise in helping investors navigate the Australian property market, identifying the best opportunities and providing expert advice every step of the way. Whether you’re looking to purchase your first investment property or expand an existing portfolio, we’re here to help you achieve your financial goals.